ALTONA™

Algorithmic Long-Term Observational Numerical Analysis framework

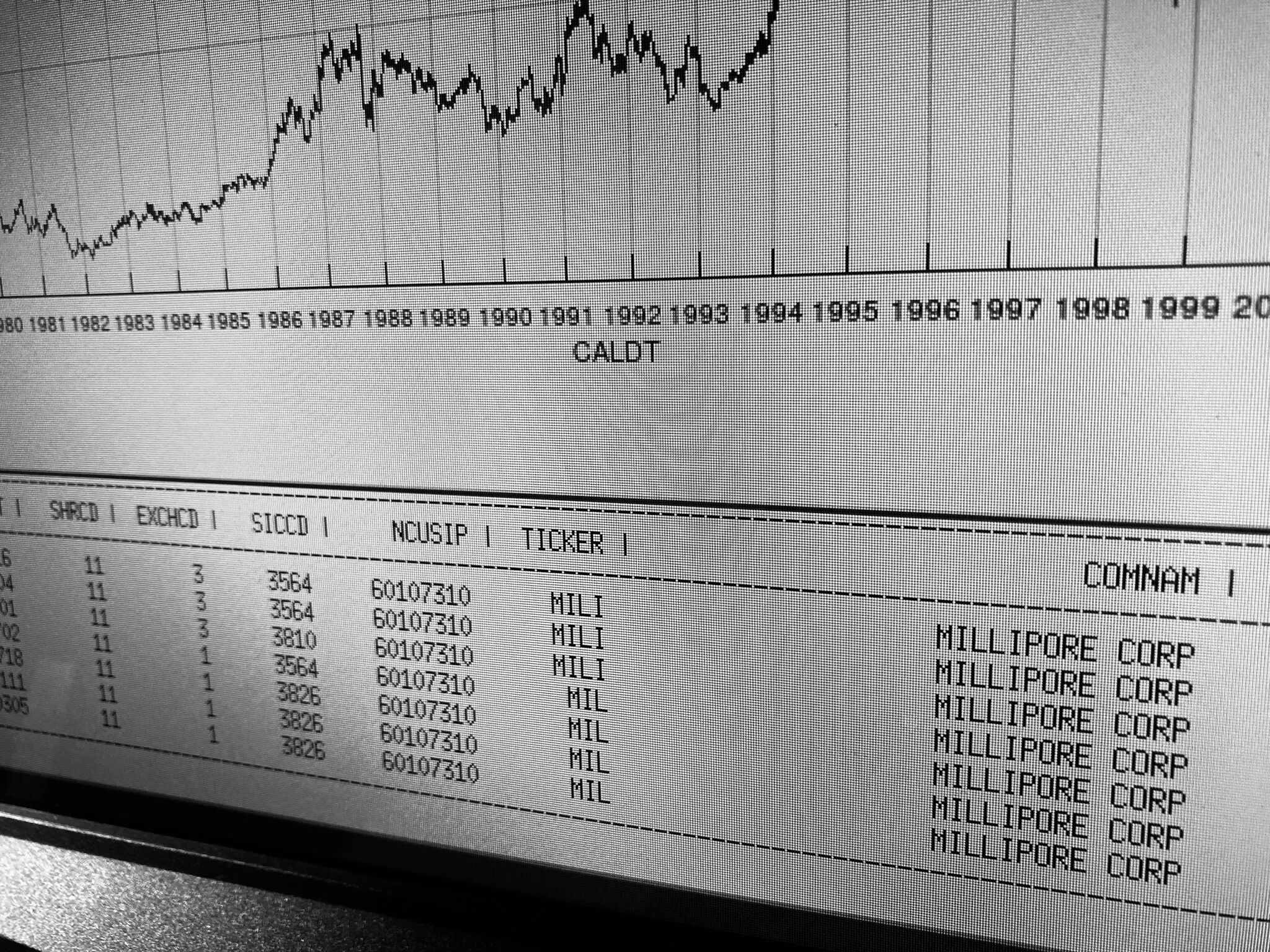

Photo: Long-term price visualization from the ALTONA™ framework.

Background

Intraday and short-term trading are often seen as the most rewarding timeframes, drawing attention to tick data and fast-moving strategies. REDSTONE™ was built for that world; short-term, data-intensive, and immediate reactions.

But what may hold true for a significant part of the buy-side industry is not necessarily true for smaller or larger capitals. The first often lacks the budget to sustain short-term operations; the latter encounters liquidity constraints almost immediately. In many cases, slowing down makes far more sense. Strategies that look beyond the next hour’s volatility spike or the next day’s close are easier to deploy and sustain. They also raise deeper questions about market efficiency and the durability of returns. These questions are often challenged by meta-studies on the sustainability of short-term strategies, and it’s natural, over time, to gravitate from short-term reactions to long-term understanding.

My own interest in how assets relate over months and years eventually matched — if not surpassed — my fascination with intraday dynamics. That shift becomes even more meaningful when you deploy your own capital: your resources are very limited, your perspective widens, and your horizon extends toward your son’s generation, not your next trade. Professionally, too, long-term strategies are where liquidity constraints fade and capital can move more intelligently.

What is Altona

ALTONA™ is a research platform to analyze cross-sectional portfolios and mid- to long-term strategies. It is MATLAB®-compatible and integrates seamlessly with WRDS/CRSP from Wharton, likely the finest financial dataset in existence. The framework simplifies exploration and research, making it possible to study how the structure and behavior of markets change across decades.

With ALTONA™, I moved from intraday trading to developing long-horizon models such as CHROME DOME™. The goal is to study regime shifts and long-term relationships between assets with the same discipline once applied to short-term data. The framework makes handling large datasets simple, so the focus stays on the analysis itself.

ALTONA™ is a technical implementation, but it also reflects a point of maturity and an attempt to look beyond short-term movement and to understand the market’s longer cycles, its underlying patterns, and ultimately, its true story.

About the name

ALTONA™ is named after a district in Hamburg — once Danish, later Prussian, and now simply a district of a German city. It reflects how markets themselves evolve through long histories and transformations.

License

ALTONA™ was built for personal use but can be licensed to hedge funds, proprietary trading or family offices.

2025-09-06