REDSTONE™

Intraday Tick Data Platform

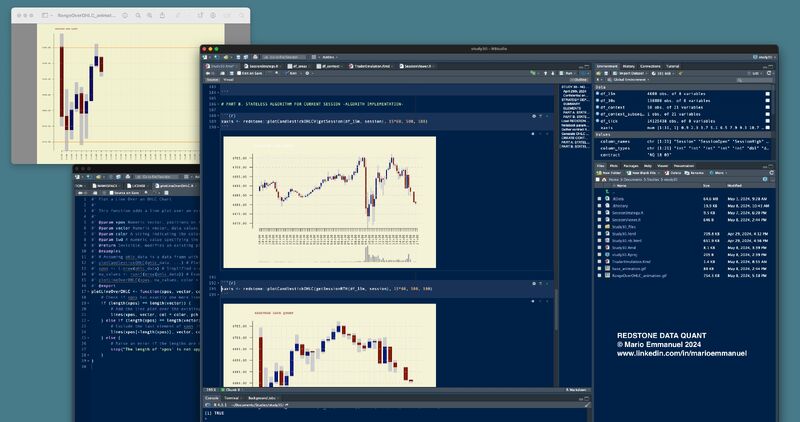

Photo: R-Studio integration of the REDSTONE™ platform — the research environment behind the data framework.

Background

I led the design and operation of the data platform for a small US-registered hedge fund. It was a long project that lasted three years and covered the entire life cycle: prototyping, design, coding, testing and daily operation in production.

The platform processed the entire universe of US equities and options at a large scale, including fifteen years of historical tick data and real-time market snapshots of both options and equities, roughly two billion messages and 1.4 million derivative contracts per day.

Over that period I went through multiple iterations, for some systems as many as seven, steadily refining the platform from the very first limited pipelines into a stable and mature environment. It enabled quantitative research, production models, and the launch of a NYSE-listed ETF by the fund.

Once the project finished I found myself without platform or data but still wanting to pursue my own research on strategies. I wanted to use tick data in the most simple way and on a platform built from scratch. I had very limited resources (both material and operational) so I evaluated different approaches that could be maintained without large budgets but that at the same time would provide all the features you need to do research and operate models in production. I asked myself the following question: how would I face this again from scratch, with more experience and without any of the external constraints present in a corporate environment, what would I do? The answer became something new, simpler, different, and far better once free from those limitations. That is how REDSTONE™ was born.

What is REDSTONE

REDSTONE™ is a data platform crafted from the ground up to serve transparently the data layer for both research and deployed models. It is simple, robust, massively cost-effective, and easy to use for small and medium hedge funds developing and operating futures and OTC strategies. It integrates seamlessly with R, Jupyter Notebooks, and C++ models. While the model currently operates for futures and OTC it can be easily extended to equities or options.

REDSTONE™ is not just a software platform: it includes the industry-specific knowledge and provides the operational answer on how data should be handled in a buy-side operation. It provides small and medium-sized hedge funds and proprietary trading firms with a platform that lets quants focus purely on research while offering a stable, scalable backbone for deployed models, all at a fraction of typical infrastructure costs.

About the name

REDSTONE™ is a fictional mineral in the game Minecraft that is used to build things that do things. It is sort of the energy of the devices built in the game. My son made me play Minecraft for hours and taught me how to use this game mineral to build devices. And since REDSTONE™ is the piece that lets you build and operate models I found it a nice name.

License

REDSTONE™ is licensable to buy-side firms seeking to avoid unnecessary complexity, friction, costs, and delay. While currently designed for OTC and futures, it can be extended to equities and options.

2025-09-13