CHROME DOME™

Systematic Investment Market Model

Model Scope

CHROME DOME™ is a systematic investment strategy designed as the primary vehicle for managing a private retirement portfolio. It seeks to preserve capital, withstand adverse market conditions, and deliver steady mid- and long-term growth — while remaining optimal under Swiss tax regulations.

Design Principles

- Balanced risk–yield profile, moderately conservative

- Built for resilience, including severe market crashes (scaled mitigation up to 90% drawdown)

- Risk adjustment based on entry conditions

- Optimized for Swiss tax treatment

- Low-cost, tax-efficient instruments

- Solid mid- and long-term yield expectations

- Diversified across asset classes and structural exposures

- Quantitative methodology grounded in empirical evidence

Approach

The model is based on long-term market patterns and macroeconomic cycles. Its rules reflect both historical relationships and forward-looking risk controls. The backtest spans multiple decades and includes varied market environments, interest-rate regimes, and crisis periods.

Particular attention is given to capital allocation under the current market conditions.

Availability and Performance

The model has been deployed with family capital since January 2024. Since inception, it has achieved yield and risk outcomes consistent with its design objectives.

CHROME DOME™ is part of my professional intellectual property. Originally developed for personal use, it may be licensed under appropriate agreements to hedge funds and family offices.

About the Name

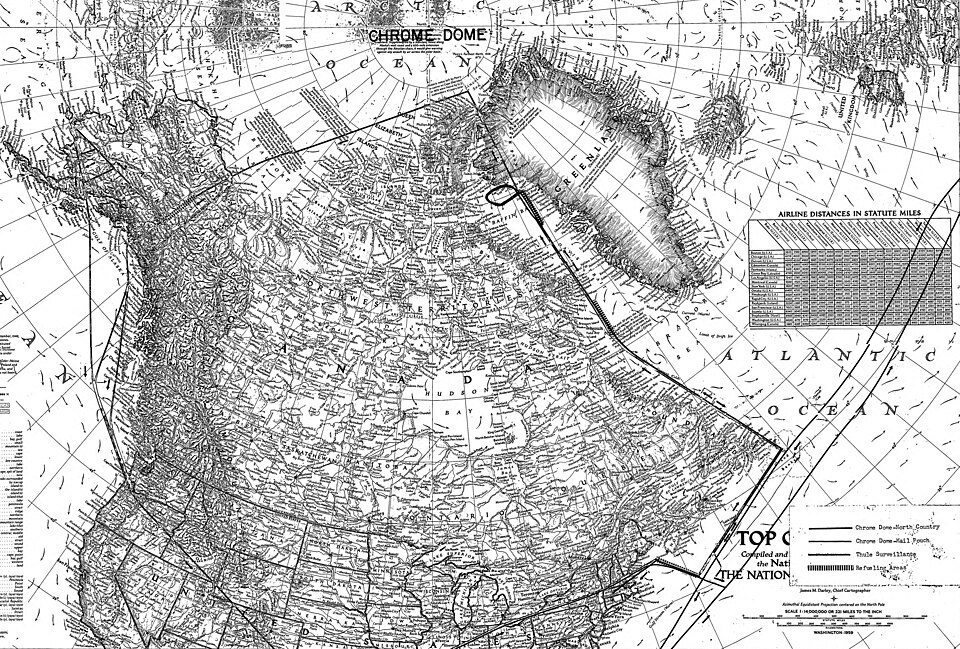

Flight paths of the Chrome Dome operation.

CHROME DOME was the codename for the Cold War–era NATO airborne operation designed to ensure survivability and continuous readiness under any circumstance.

Similarly, this investment model is structured for continuity and resilience — built to endure deep market shocks, adapt to changing regimes, and remain operational through every condition the markets may impose.

2025-10-15